When you contribute to charitable organizations in India, you not only make a positive impact on society but also gain potential tax perks. This is where Section 80G of the Indian Income Tax Act comes into play. It allows for deductions on your taxable income when you donate to registered institutions. To maximize your tax reductions, it's crucial to grasp the nuances of Section 80G donations.

,First and foremost, you need to ensure that the organization you are donating to is listed under Section 80G. You can verify this information on the website of the Income Tax Department.

Next, be aware that different organizations fall under different groups within Section 80G, each offering varying deductions. Some offer a full deduction on your contribution, while others offer a restricted deduction.

,Moreover, keep meticulous records of your donations, including the date, amount, and name of the organization. This documentation will be essential if you are ever reviewed. Consulting with a tax professional can provide valuable assistance in navigating the complexities of Section 80G and ensuring that you claim all eligible deductions.

Tracking Charitable Donations: A Journal Entry Guide

When making charitable contributions, it's crucial to maintain accurate financial records. This involves properly recording donations in your accounting system through charity donation tax credit journal entries. A journal entry is a fundamental bookkeeping technique used to document financial transactions.

- Regarding charitable donations, a common entry type involves debiting the "Donation Expense"line item and crediting the "Cash"fund account.

- The amount debited should reflect the aggregate value of your charitable contribution.

- Be sure to include a detailed narrative for each donation in the bookkeeping log's memo section.

This provides valuable information for tracking your charitable support. Consulting with a accountant can help ensure you are recording donations accurately and maximizing any potentialcredits.

Charitable giving can be a rewarding experience, but to truly amplify your impact, it's crucial to adopt best practices.

One key principle is carrying out thorough research before you donate. Grasp the organization's mission, accountability, and results. Look for organizations that are transparent about their work and have a proven track record of success.

A well-crafted giving plan can optimize your charitable efforts. Determine your philanthropic goals and allocate your resources accordingly. Consider making regular gifts rather than one-time payments.

- To further enhance your impact, research opportunities for volunteering.

- Your skills and talents can offer invaluable support to non-profits.

- Make certain that you obtain a formal receipt for each contribution of at least fifty dollars.

- Make sure your receipt lists the sum of the gift and the title of the nonprofit.

- Store your receipts in a safe location for at least a period of three years, as this is the minimum duration recommended by the IRS.

- Explore charities thoroughly before donating. Look into their mission statements, financial transparency, and impact. Websites like Charity Navigator and GuideStar offer valuable data to help you make wise decisions.

- Evaluate different ways to contribute. Donating money is certainly helpful, but there are also opportunities to lend a hand or spread awareness through social media.

- Be aware that even small gifts can add up. Every little bit helps!

Remember that even small gifts can create change. By following these best practices, you can guarantee that your charitable giving authentically makes a meaningful impact on the world.

Essential Receipts for Tax Purposes

When making charitable contributions, it's vital to keep track of your donations. A voucher from the nonprofit is essential documentation for filing your taxes.

The Power of Giving

Giving altruistically is a profound demonstration that can transform lives and communities. Charitable donations, no matter the scale, have a tangible impact on those in need, providing vital support.

Via economic contributions, organizations can fund essential initiatives, such as healthcare, which immediately improve the well-being of individuals and families.

Beyond the material benefits, charitable giving fosters a feeling of community. It unites people around a shared goal, creating a more caring and supportive society.

Finding Your Path: How to Support Charities Wisely

Want to contribute positively through charitable giving but feel overwhelmed by options? You're not alone! Navigating the expansive world of charities can be confusing. But don't worry, with a little awareness, you can find the perfect charity to support your passions and make a meaningful impact.

Start by pinpointing the causes that matter most. Are you passionate about environmental protection? Concentrating your efforts on a cause you truly care about will enrich your giving experience.

Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Keshia Knight Pulliam Then & Now!

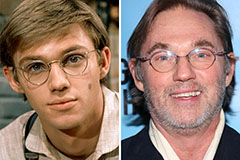

Keshia Knight Pulliam Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!